Introduction: Why Property Types Matter

Real estate comes in countless forms, from cozy condos and sprawling suburban homes to bustling commercial buildings and multi-family complexes. Choosing the right property type can be the defining factor in your long-term satisfaction and financial success. Whether you’re purchasing your first home, expanding your investment portfolio, or simply looking for a change of scenery, understanding different property types is crucial. This comprehensive guide will walk you through the most common property categories, highlighting their advantages, drawbacks, and the lifestyles or investment goals they best serve.

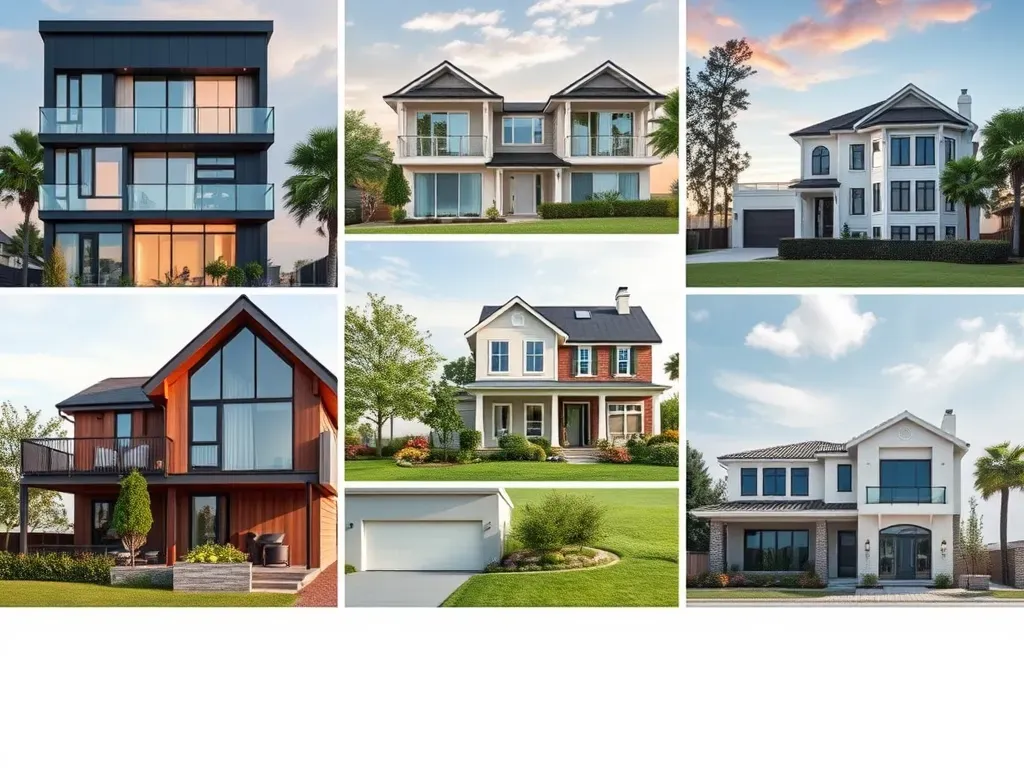

Single-Family Homes: Independence and Private Space

The single-family home stands as a cornerstone of traditional homeownership. Typically occupying its own parcel of land, it offers privacy, space, and the freedom to customize.

Key Benefits

• Privacy and Control: No shared walls or communal areas means you can enjoy outdoor space, undertake renovations, and personalize your property without worrying about homeowners’ associations (HOAs) or shared-building restrictions.

• Potential for Appreciation: Well-located single-family homes can appreciate steadily, especially in desirable neighborhoods with strong job markets.

• Family-Friendly Atmosphere: Single-family properties often feature backyards and plenty of room for children or pets.

Potential Challenges

• Maintenance Costs: Owning a house involves handling all repairs, landscaping, and upkeep on your own.

• Higher Entry Costs: Purchasing a single-family home typically requires a larger down payment and higher mortgage payments compared to smaller or shared properties.

Condominiums: Modern Convenience with Shared Amenities

A condominium (condo) is a private residence within a larger complex or building, where common areas and amenities are jointly owned and maintained. Ideal for busy individuals or those seeking a more urban lifestyle, condos can range from affordable starter homes to lavish penthouses.

Why Condos Appeal to Many Buyers

• Lower Maintenance Responsibilities: Exterior upkeep, landscaping, and shared facilities—like gyms or pools—are usually handled by the condominium association.

• Community Amenities: Many condo developments feature amenities like fitness centers, lounge areas, and security services, enhancing convenience.

• Urban Locations: Condos are often situated near city centers, allowing easy access to public transportation, shopping, and cultural events.

Drawbacks to Consider

• Monthly HOA Fees: These can be substantial, adding to your overall housing expenses.

• Limited Privacy: Shared walls, hallways, and facilities can reduce the sense of personal space.

• HOA Rules: While they help maintain property values, associations often impose restrictions on renovations, pets, or rentals.

Townhouses: A Middle Ground Between House and Condo

Townhouses (or row houses) bridge the gap between condos and single-family homes. They share one or more walls with neighboring units but typically include multiple levels and a small yard or patio.

Why Townhouses Are Popular

• More Space and Privacy than Condos: While you share walls, you often enjoy multiple floors, a private entrance, and sometimes a dedicated yard or driveway.

• Lower Maintenance than Single-Family Homes: Exterior upkeep is often partially covered by a homeowners’ association, reducing personal workload.

• Affordability: Townhouses can be more budget-friendly than detached homes, especially in high-demand urban areas.

Potential Downsides

• HOA Restrictions: As with condos, you may need approval to change exteriors or add features, limiting your freedom for renovations.

• Noisy Neighbors: Sharing walls can mean sound travels easily, affecting privacy.

Multi-Family Properties: Investment and Income Generation

Multi-family properties, like duplexes, triplexes, or apartment complexes, contain multiple housing units on a single parcel of land. They’re especially appealing to investors or homeowners seeking rental income.

Advantages of Multi-Family Investments

• Rent Collection: Renting out extra units can offset mortgage costs and even create positive cash flow.

• Diversification: Having multiple units in a single property reduces the impact of vacancies—one empty unit won’t eliminate all income.

• Tax Benefits: Similar to single-family rentals, owners can deduct maintenance and depreciation costs, lowering taxable income.

Points to Consider

• Management Complexity: More tenants mean more maintenance requests, rental agreements, and potential conflicts. Many owners hire property managers to streamline operations.

• Higher Initial Cost: Multi-family properties often require larger down payments, and lenders may impose stricter qualification criteria.

Commercial Properties: Higher Returns with Greater Complexity

Commercial real estate includes office buildings, retail centers, industrial warehouses, and specialized facilities like medical clinics. While it can offer lucrative returns, commercial property demands a deeper understanding of market trends and leasing nuances.

Why Commercial Can Be Lucrative

• Higher Rental Yields: Commercial properties often command higher rents per square foot, leading to substantial monthly income.

• Long-Term Leases: Commercial leases tend to be longer, ensuring steady cash flow and reducing tenant turnover.

• Triple Net Leases: In many commercial agreements, tenants cover property taxes, insurance, and maintenance, minimizing the landlord’s out-of-pocket costs.

Challenges of Commercial Ownership

• Market Volatility: Economic downturns can hit businesses hard, leading to vacancies and rent defaults.

• Complex Zoning and Regulations: Commercial investments often involve more stringent building codes, permits, and use restrictions, increasing the complexity of operations.

• High Capital Requirements: Purchasing commercial properties usually involves larger loans and down payments.

Raw Land: Potential for Long-Term Appreciation

Investing in raw land involves purchasing undeveloped property with the hope of future development or value increase. While this can yield significant returns if the area appreciates or new infrastructure emerges, it’s also a risky strategy requiring patience.

When to Consider Raw Land

• Speculative Growth: If you anticipate population booms or planned infrastructure projects, land prices could soar.

• Agricultural Opportunities: Farming, ranching, or timber harvesting can provide income without constructing buildings.

• Custom Development: Owning land allows you the freedom to develop it as you see fit when the timing is right.

Risks and Drawbacks

• Lack of Cash Flow: Raw land typically doesn’t generate rental income unless you lease it for agricultural or resource extraction purposes.

• Carrying Costs: You’ll still pay property taxes and possibly maintenance costs (like weed control or fencing) even if there’s no immediate revenue.

• Market Uncertainty: Predicting future growth can be challenging, and if development plans fall through, your investment may stagnate.

Specialized Property Types: Meeting Niche Demands

Beyond the main categories, certain specialized properties cater to unique needs. These can be rewarding yet often require deeper expertise.

Vacation and Short-Term Rentals

Platforms like Airbnb have popularized short-term rentals, allowing property owners to cater to tourists or business travelers. Prime vacation spots near beaches, mountains, or cultural landmarks can command premium nightly rates, but also involve seasonal fluctuations and intensive management.

Benefits vs. Challenges

• Potential for High Income: Nightly rates can exceed long-term monthly rents in sought-after locations.

• Frequent Turnover: Higher vacancy risk and additional tasks like cleaning, restocking, and marketing.

Senior Housing and Assisted Living

With aging populations, demand for senior-focused properties—like assisted living facilities or retirement communities—continues to rise. These often require specialized licensing, staff, and infrastructure but can offer stable occupancy rates and premium rents.

Points to Note

• Expertise Needed: Providing services to seniors can involve regulatory compliance, caregiving, and specialized safety measures.

• Longevity of Demand: Demographic trends suggest sustained need for senior housing, potentially offering stable long-term investment returns.

Balancing Lifestyle with Financial Goals

Selecting the ideal property type isn’t just about numbers—it also involves your preferences, schedule, and tolerance for risk. Some people prioritize easy maintenance and community living, gravitating toward condos or townhouses, while others want the autonomy of a standalone home. Investors might aim for the diverse cash flow of multi-family buildings or the higher stakes of commercial ventures.

The Role of Location in Property Types

No matter which property type you choose, location remains a determining factor in occupancy rates, appreciation, and overall desirability. A high-end condo in a stagnant market may underperform compared to a modest single-family home in a thriving suburb. Thorough market research—spanning local job growth, economic indicators, and neighborhood amenities—can guide you to a property type that excels in its specific locale.

Future Development Plans

Stay informed about planned infrastructural upgrades, zoning changes, and commercial projects. Even a less-popular property type might become lucrative if big developments—like a new corporate campus or major transit extension—are on the horizon.

Conclusion: Finding Your Perfect Real Estate Fit

Choosing among property types is a pivotal step in your real estate journey, be it personal homeownership or strategic investment. From the privacy of single-family homes to the income potential of multi-family properties or the convenience of condos, each category suits different lifestyles and objectives. The key lies in balancing your financial goals, desired level of involvement, and market conditions. With careful consideration and thorough research, you can select a property type that not only meets your current needs but positions you for future growth and success in the ever-evolving real estate world.

Leave a Comment